Consumer sentiment slightly higher in January on seasonal spend and positive jobs news

-

Marginal improvement reflects consumer caution and difficulty in assessing 2019 outlook

-

Consumers downgrade economic outlook further …

-

…but positive jobs reports encourage optimism

-

Seasonal spending plans also increase but suggest a cautious consumer as well as changed spending habits

Analysis by Austin Hughes, Chief Economist, KBC Bank Ireland

Irish consumer sentiment edged higher in January as post-Christmas sales and positive jobs news more than offset ongoing Brexit concerns. As consumers continue to juggle the risk of the UK crashing out of the EU with the reality of modestly improving conditions of late, the likelihood is that sentiment and spending indicators will remain on a choppy path in early 2019. As bills for Christmas spending arrive and UK difficulties in delivering the EU withdrawal agreement increase, the likelihood is that Irish consumer confidence will weaken in February.

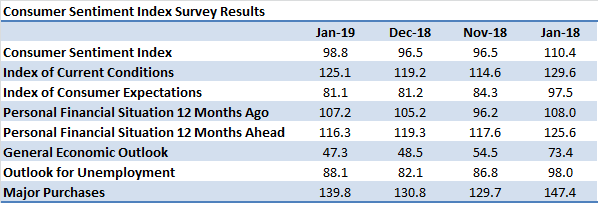

The KBC Bank ESRI consumer sentiment index increased to 98.8 in January from 96.5 in December, the second monthly increase in the past three months but one which leaves the current reading well below the 2018 average of 102.5.

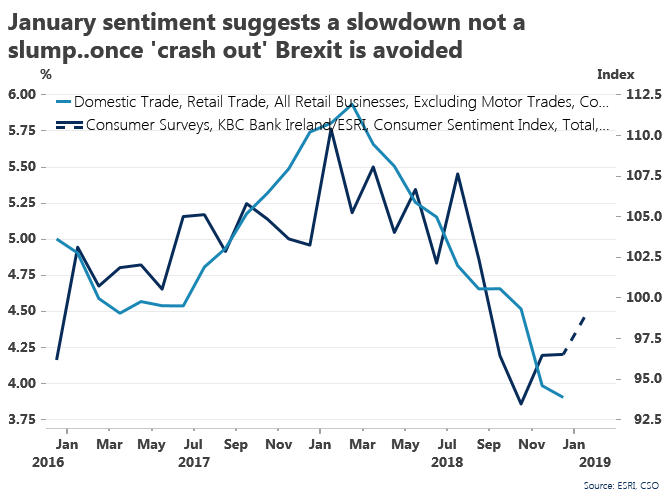

As the diagram below indicates, the sharp weakening in sentiment that occurred between July and October has been followed by a period of relative stability of late as consumers await further clarity on Brexit to assess whether 2019 will be a year that pivots towards promise or pain.

The graph which compares movements in sentiment to the smoothed trend in retail sales suggests Irish consumers have adopted a more cautious approach of late. So, there seems to be scope for either a soft Brexit ‘bounce’ or a hard Brexit ‘bump’ in spending as 2019 progresses.

The small improvement in Irish consumer sentiment in January was at odds with a sharp drop in the corresponding US indicator that likely reflected a combination of concerns related to the Federal Government shutdown and the sell-off in equity markets in late 2018. In contrast, Euro area consumer confidence edged higher, in part because of a likely seasonal easing in the worries weighing on French consumers while UK consumer confidence held steady albeit at a relatively weak level.

Our sense is that, as in previous years, a significant Christmas and New Year break entailing a shift in focus away from financial news towards family and friends likely gave some boost to January sentiment readings in many countries on this side of the Atlantic. In this context, reflecting the survey period encompassing the first half of the month, Irish consumer sentiment has risen in January in twenty of the past twenty three years. In contrast, a shorter break and the greater near term disruption caused by the Government shutdown in the ‘States would go some way towards explaining the particular weakness in recent US confidence measures.

The details of the Irish sentiment reading for January highlight the ‘cross-currents’ affecting consumer thinking at present with three of the elements of the survey higher and two weaker than in December. The contrasting responses to various elements of the survey suggest consumers aren’t simply blinded by Brexit even if they are struggling to assess the likely extent and timing of any fallout.

Not surprisingly, the weakest element of the survey in January, as in recent months, was consumers’ assessment of the outlook for the Irish economy. For the second month in a row, more consumers expected weaker rather than stronger conditions to prevail in the next twelve months. Although the number expecting an improving economy climbed slightly from 26% to 28% of respondents, the share fearing weakness increased more from 32% to 36%.

In the absence of any dramatic new developments in the Irish economy, with the possible exception of positive news in the shape of an earlier than generally expected return to surplus in the public finances, our strong sense is that political chaos in the UK and associated concerns about a related Brexit fallout on the Irish economy drove this result.

In marked contrast to consumers’ concerns about the outlook for economic activity, there was a slight improvement in thinking on the outlook for jobs. This divergence likely captures the difficulty Irish consumers (and economists) are having in assessing the path the Irish economy is likely to take in the year ahead.

Our sense is that responses to the jobs question in the survey were heavily influenced by upbeat end of year reports by the IDA and Enterprise Ireland in addition to a continuing sequence of new job announcements by a range of companies. Such announcements underpin the current reality of healthy growth that must be weighed against the threat posed by Brexit. Concerns about the threats posed by Brexit and perhaps by specific warnings about related increases in prices or even shortages of food may have contributed to a slight marking down of the outlook for household finances in the year ahead. In contrast, consumers were marginally more positive when asked how their personal finances had developed in the past year.

More notably, as typically happens in the January survey, spending plans picked up reflecting the lure of post-Christmas sales. However, the monthly increase was the smallest seen in any January since 2002. In part, this may reflect changing shopping patterns such as the advent of ‘Black Friday’ or the practice of ‘perma-sales’ in some sectors. We think this more muted seasonal spend also reflects a more cautious Irish consumer even if January VAT receipts suggest spending growth is still solid.

Commenting on the results Philip Economides, ESRI, said:

The gain in confidence this month is often referred to as the ‘January Effect’. The uplifting sense of a new year combined with recent holidays often result in highly optimistic responses. However, this same effect did little to diminish the loss of confidence in the broader economic outlook. The general economic outlook indicator fell further to 47 points in January, a considerable weakening of economic confidence. These concerns will unlikely to dispel until adequate progress is made in ongoing Brexit negotiations.

In addition, Austin Hughes, KBC Bank Ireland, noted:

The uptick in sentiment in January is encouraging in that it suggests Irish consumers are not completely overwhelmed by Brexit gloom. Although the details highlight fears the Irish economy might weaken and more caution in relation to spending plans, they also suggest consumers recognise the continuing strength of the jobs market.

The mixed details of the January sentiment survey highlight the problems consumers are having in determining what direction the Irish economy and their own financial circumstances might take in 2019. They are trying to balance the risks threatened by a hard Brexit with the reality of ongoing improvements in the economy in recent years. The slight uptick in sentiment in January suggests they are still cautiously positive as they await some clarity on how Brexit might evolve.